Here in Spain the next election is a long way off. Today, my student was talking about the proliferation of 'fines' in Spain. The population are to be fined for every minor infringement you can imagine. On my way back from this class I was fined on the metro. I bought a new ticket and accidently threw away the last one.. The message is cross every 't' and dot every 'i' because human error will not be tolerated.

Spain is watching Greece closely. The global merchant bankers have been helping Zapatero hide his debts and releasing more 'loans' using derivative finance. When the bomb hits Spain will have to sell off its schools, hospitals, roads and everything else to clients or subsidieries of Goldman or JP Morgan. The very boys who helped Greece and Spain conceal the debts.

Problem is now the real situation is coming out into the open. Spain has a mountain of debt and will have to cut public spending massively, something Zapatero is saying he won't do but he'll have no choice. It's looking more possible that Spain may have to leave the Euro, return to the Peseta and devalue before joining again.

It's all down to debt. Having borrowed so much there is no more collateral to borrow against and even if there was the banks won't lend because they're lying about their balance sheets. So, government is going to make the cuts, increase the taxes and fines and banks are going to add more charges to accounts. There is no choice unless they demand the money back they've given to banks in the form of bail-outs and quantative easing. The people are loaded up with debt so by continuing to be squeezed extreme hardship will ensue. People are going to go hungry and going to go crazy.

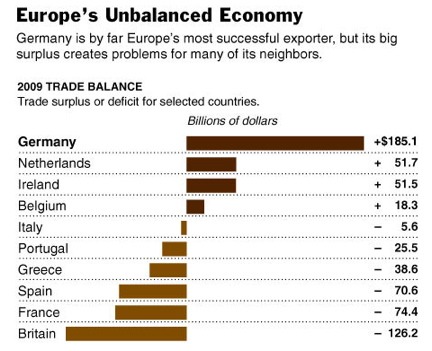

That's Spain, so let's look at Europe as a whole/hole:

O oh, Britain is in a far worse position than Spain. The good news, for Spain, is that their population has much less private debt than Britain's. Yep, London is going to need a lot more money from you and you already have more personal debt than the rest of the EU combined.

What does this all mean? Well, look to Ireland and Greece for an indication but make no mistake, Britain is worse. Civil servants will loose jobs and their salaries will be hacked to bits. Benefits will be capped, you'll be fined for milimetre parking infringements, public transport costs will escalate, police numbers will be reduced as crimes against property and person increase, banks will continue putting up charges, they'll make cash transactions of more than GBP1500 illegal, as it becomes clear they're going to devalue the pound they'll stop all international cash transactions. You may be ordered to hand in all private gold you hold, they'll tax property owners so that even if you own your property you'll lose your wealth. The list will go on and on and on. Forget higher education, forget retiring at 65 expect house prices to drop further.

When he prints more money he's diluting your wealth. You put up with that because you compare yourself to the Jones's but international investors don't. They compare the value of their investment against the global market. As the value of their currency and bonds decline they'll get rid of their pounds. In the last few days investors have been selling pounds and even buying Zimbabwe dollars with them..

I've read newspaper after newspaper tell us that the government should borrow more money to spend to facilitate recovery. That might work if the system does not have a debt/credit problem. The problem is that we are not in recession, we have a system failure caused by too much debt and so borrowing more is absolute lunacy. Yet, financial commentators advocate it just the same. And I've read bloggers talk about Alisdair Darling's competence.

I've read newspaper after newspaper tell us that the government should borrow more money to spend to facilitate recovery. That might work if the system does not have a debt/credit problem. The problem is that we are not in recession, we have a system failure caused by too much debt and so borrowing more is absolute lunacy. Yet, financial commentators advocate it just the same. And I've read bloggers talk about Alisdair Darling's competence.

The truth is that debt empowers banks and enslaves citizens. After the election you are going to get slaughtered. Expect civil unrest, political instability and possible law and order malfunction. If currencies decline quickly the food supply can be interrupted so make sure you've got a couple of months of grub just in case.

And when you realise that 'recovery' was all baloney, that you sleepwalked into a nightmare and you work for the banks that you had the chance to vote for independence..

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_bpoz_2.gif)

No comments:

Post a Comment